All that hard work has finally paid off! You got a raise at work. Now what?

As you bask in the glow of a job well done, planning ahead for your new future should stay in the forefront of your mind. After all, it takes money to make money! But even just a little boost can get help get you started. Now is the time to review your household budget, your cost of living and take stock of your financial pulse.

GET STARTED (FOR FREE)

Check Your Credit Reports

Federal law enables you to get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct and up to date. Reviewing credit reports alert’s you to signs of identity theft early.

Setup A CreditKarma.com Account

CreditKarma.com breaks down what can impact your score with TransUnion and Equifax. Setting up an account is free. You can continuously monitor your status and receive actionable recommendations for ways to improve your credit.

(1) Credit Card Utilization = High Impact

The amount of your total available credit that you’re using. This is also broken down by credit card. The overall utilization is most important, however, any credit cards that are close to their limits will also have an impact on your credit score.

Your total credit card balance / Your total credit card limit = Your credit card utilization

- 0-9% = Excellent

- 10-29% = Good

- 30-49% = Fair

- 50-74% = Poor

- 75% + = Very Poor

(2) Payment History = High Impact

The percentage of payments you’ve made on time. Lenders look at your on-time payment history to determine whether you’re likely to make future payments on time. This report not only provides the calculation but also outlines any missed payments (which you may be able to have removed by filing a dispute with the credit bureau).

Your on time payments / Your total payments = Your on time payment percentage

- 100% = Excellent

- 99%= Good

- 98% = Fair

- 97% = Poor

- < 97% = Very Poor

(3) Derogatory Marks = High Impact

The number of collection accounts, bankruptcies, foreclosures, civil judgments or tax liens on your report.

- 0 = Excellent

- 1 = Fair

- 2-3 = Poor

- 4+ = Very Poor

(4) Age of Credit History = Medium Impact

The average length of time your accounts have been open. This is calculated by averaging the ages of your open credit accounts. This report also outlines the length of each account.

- 9+ yrs = Excellent

- 7-8 yrs = Good

- 5-6 yrs = Fair

- 2-4 yrs = Poor

- < 2 yrs = Very Poor

(5) Total Accounts = Low Impact

The total number of open and closed accounts on your report.

- 21+ = Excellent

- 11-20 = Good

- 6-10 = Poor

- 0-5 = Very Poor

(6) Credit Inquiries = Low Impact

The number of “hard pulls” on your credit report for things like credit applications in the last two years.

- 0 = Excellent

- 1-2 = Good

- 3-4 = Fair

- 5-8 = Poor

- 9+ = Very Poor

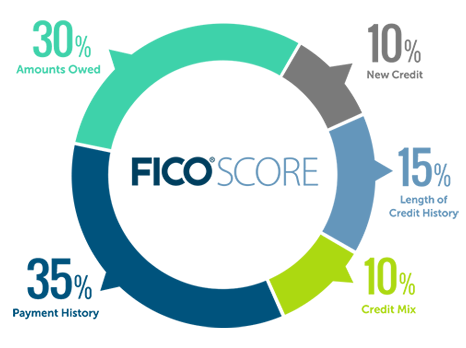

In it’s simplest form, all these categories will also combine to give you a FICO® Score which is basically a common language for lenders to determine your credit risk and the interest rate you will be charged before you take out a loan.

WHAT IS A FICO® Score AND HOW IS IT CALCULATED?

FICO® Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how your FICO® Score is calculated. Your FICO® Score consider both positive and negative information in your credit report. Late payments will lower your FICO Scores, but establishing or re-establishing a good track record of making payments on time will raise your score.

If you’re looking for an auto loan, credit card, mortgage or student loan, lenders will determine your credit-worthiness based on your FICO® scores from each of the 3 major bureaus, Equifax, Experian, and TransUnion. Before you consider taking on any substantial debt, take a moment to review your FICO® Score to understand how lenders see you. This report is a fee for service and typically costs $20 for each report your run. Visit www.myfico.com for more info.

WHAT’S NEXT?

FIX YOUR CREDIT

CreditRepair.com is a good option if you have some credit issues that are not very recent. Examples include derogatory marks or missed payments in your history that are over two years old. If your credit history has recent or current issues, success isn’t as likely using platforms like these. Look for special offers and keep an eye on the payment terms. The wording is a little vague, but there is a setup fee along with monthly fees. Still worth it if you get positive results. After only three months on the platform, our friend Tammy had over a 50 point increase in her credit score. You must provide some input regarding what “track” of disputes you’d like to follow (e.g. Recent Divorce vs. Student Debt) and agents reach out to creditors on your behalf to remove negative items. You can also do this on your own, but tools like CreditRepair.com are good options to make sure the work is getting done with limited stress.

Opening a store credit card is another effective way to increase your credit score and an ideal way for someone with a lower credit score to begin rebuilding his or her credit. You don’t need to have a perfect credit score to get approval for store credit cards. Getting approval for the credit card increases your credit limit thus driving down your utilization ratio as well as diversifying your types of credit. A utilization rate below 30% helps prove you aren’t a risky borrower and can increase your credit score. So, if your overall credit limit went from $5,000 to $8,000, and you continued to only spend about $1,200 on cards each month, you could lower your utilization from about 25% to about 15%.

As you improve your credit score, refinancing your credit cards is another way to drive down your overall utilization of lines of credit (by opening up a new loan) while decreasing the interest you pay to creditors (personal loans typically have lower rates than credit cards) as you pay down your debt. 75% of Lending Club customers experienced a FICO® Score increase three months after getting their personal loan; the average score increase was 20 points. You have the flexibility to pay off your loan whenever you want and get rid of future interest payments. No prepayment penalty.

PAY OFF DEBT

The Waterfall or Ladder payment method is for consumers who want to save the most money in the long-term. You need to be self-disciplined and function well without a lot of rewards along the way. In this method, you will put your debts in order of interest rate from highest to lowest. You will pay the minimum payment to each account every month and then take your extra available funds and put them toward the account with the highest interest rate. This reduces your spend in the long run.

The Snowball method may not save you as much money in the long run, but you’ll see quicker rewards in paying offer more accounts up front. It’s best to start when you are current on all bills and have at least $1,000 saved in an emergency fund. Pay minimum payments on all of the debts except the smallest one then attack that debt with a vengeance. Once it’s gone, take the money you were putting toward that debt, plus any extra money you find, and attack the next debt on the list. Continue until all debt is paid off.

INVEST

Open An IRA: An Individual Retirement Account (IRA) is a type of savings account that is designed to help you save for retirement and offers many tax advantages. There are two different types of IRAs: Traditional and Roth IRAs. Do some research and determine the right kind of IRA for you and check out banks like USAA (dedicated to serving military members and their families by offering more benefits than any other major financial service provider). You can open an account with as little as $25-30 a month.

Wealthfront is a modern day option for retirement planning. It’s an online investment platform that claims to be “the most tax-efficient, low-cost, hassle-free way to invest”. It is a no commission, hassle free, set it and forget it investment vehicle that will probably appeal to the millennial crowd. Wealthfront invests in Index Funds to keep fees low and diversification high to maximizes long-term returns. Take a couple of minutes and complete their risk assessment quiz to see the exact portfolio they’d put you in. Wealthfront’s investment team accumulates more than 200 years of investment experience and has authored more than 16 investment books.

Peer-To-Peer Lending: Platforms like the Lending Club boast low volatility and monthly cash flow. These platforms are also another option for retirement savings; however, there are many different types of accounts available.

Other Investing & Trading: If you know anything about the stock market or have some personal interest in investing in certain services or companies, platforms like eTrade make it easy to get started with just a few hundred dollars. There’s a much higher risk involved in some of these options, but that also means a bigger potential payout. Just be sure that you get started with money that you can afford to lose.

The main goal is to find ways to put your hard earned money to work for you. Take stock of your current financial pulse and go from there.

mage Credit: www.myfico.com

Please note, this article is purely informational and we are not offering financial advice and do not claim to be any kind of financial gurus!

The post Show Me The Money! You Got A Raise. Now What?! appeared first on Construction Recruiters, Inc..